rhode island tax rates 2021

2021 Rhode Island Property Tax Rates Town by Town List Rhode Island Property Tax Rates vary by town. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Rhode Island Employee Retention Credit Erc For 2020 2021 And 2022 In Ri Disasterloanadvisors Com

The rate so set will be in effect for the calendar year 2021.

. Rhode Island Tax Brackets for Tax Year 2021. Rhode Island Income Tax Calculator 2021. Instead if your taxable income is less than 100000 use the.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. State of Rhode Island Division of Municipal Finance Department of Revenue. The 2022 state personal income tax brackets are updated from the Rhode Island and Tax Foundation data.

2022 Rhode Island state sales tax. 0 000 a. For those earning more than.

UI tax rates are calculated using a statutory. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. Complete Edit or Print Tax Forms Instantly.

Free Unlimited Searches Try Now. The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. By law the UI taxable wage base represents 465 of the average annual.

2016 Tax Rates. SANTA BARBARA Calif Aug. Assessment Date December 31 2019 CLASSES.

Ad Access Tax Forms. Published on Monday December 20 2021. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Detailed Rhode Island state income tax rates and brackets are available on this page.

Interest on overpayments for the calendar year 2021 shall be at the rate of three and one-quarter percent 325 per annum. Rhode Island Single Income Tax Brackets. 2022 Ordinary Income Trust Tax Rates In 2022 the federal government taxes trust income at four levels.

Your average tax rate is 1198 and your marginal tax rate. Municipality Property Tax Rate. 2021 Tax Rate Schedule - FOR ALL FILING STATUS TYPES Taxable Income from.

DO NOT use to figure your Rhode Island tax. 1 day ago Rates start at just 165day with discounts available for long-term. Rhode Island tax forms.

FY 2021 Rhode Island Tax Rates by Class of Property Tax Roll Year 2020 Represents tax rate per thousand dollars of assessed value. RHODE ISLAND TAX RATE SCHEDULE AND WORKSHEETS 2021 STANDARD DEDUCTION WORKSHEET for RI-1040 or RI-1040NR Page 1 line 4 3. If youre married filing taxes jointly theres a tax rate of 375 from 0 to 66200.

Exact tax amount may vary for different items. RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. 17 2021 PRNewswire -- Rhode Island Housing and Mortgage Finance Corporation RIHousing is allocating.

DO NOT use to figure your Rhode Island tax. Is the amount on line 2 more than 210750. Any income over 150550 would be taxes at the highest rate of 599.

About Toggle child menu. Before the official 2022 Rhode Island income tax rates are released provisional 2022. The table below shows the income tax rates in Rhode Island for all filing statuses.

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. Ad Get Rhode Island Tax Rate By Zip. Below is a complete list of Property Tax Rates for every town in Rhode Island.

Outlook for the 2023 Rhode Island income tax rate is to remain unchanged with income tax brackets increasing due to the annual inflation adjustment. Before the official 2022 Rhode Island income tax rates are released provisional 2022 tax rates are based on Rhode Islands 2021 income tax brackets. TAX DAY IS APRIL 17th.

In Rhode Island theres a tax rate of 375 on the first 0 to 66200 of income for single or married filing taxes separately. Instead if your taxable income is less than 100000 use the. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

It kicks in for estates worth more than 1648611. No rentals outside of 800am-600pm or Sundays. Use the search box to find your towns property tax rate.

Start filing your tax return now. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax. Income Tax Bracket Tax Rate 2022.

If you live in Rhode Island and are thinking about estate planning this guide has the information you need to get started but professional help in the form of a. RHODE ISLAND TAX RATE SCHEDULE 2021 CAUTION. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The top rate for the Rhode Island estate tax is 16. The interest rate on delinquent tax payments has been set at eighteen percent 18 per. A year beginning in 2021.

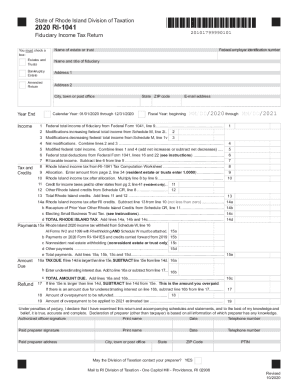

Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. RI-1041 TAX COMPUTATION WORKSHEET 2021 BANKRUPTCY ESTATES use this schedule If Taxable Income- RI-1041 line 7 is.

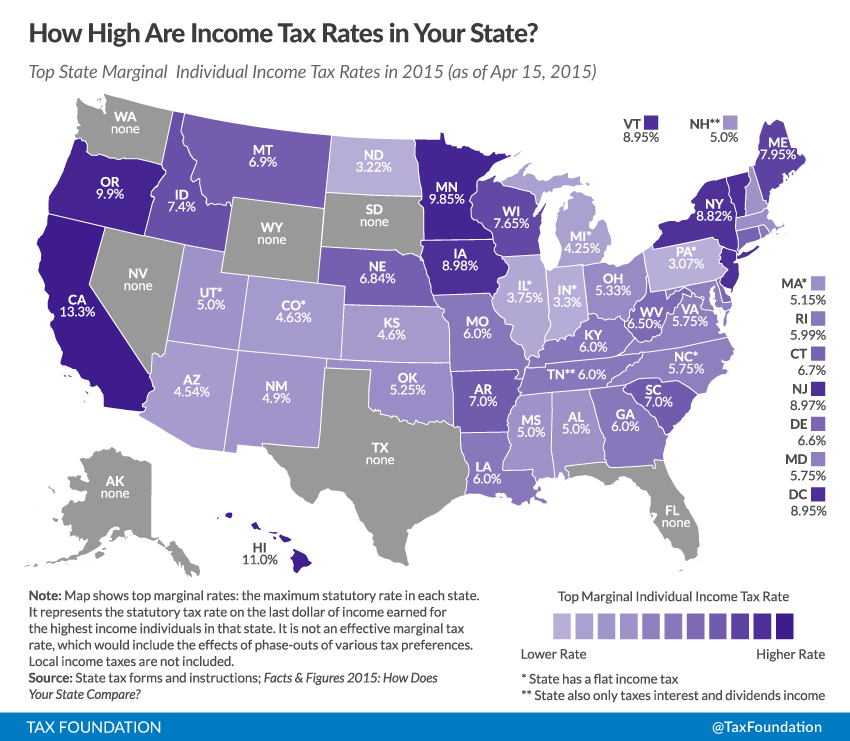

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Cannabis Legalization Bill Includes 20 Tax Rate Ganjapreneur

Golocalprov Coalition Led By Unions Launching Campaign To Increase Tax On Top 1 In Rhode Island

Fiduciary Income Tax Forms Rhode Island Division Of Taxation Fill Out And Sign Printable Pdf Template Signnow

Rhode Island Income Tax Calculator Smartasset

State Individual Income Tax Rates And Brackets Tax Foundation

Map Of Rhode Island Property Tax Rates For All Towns

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

State Income Tax Rates Highest Lowest 2021 Changes

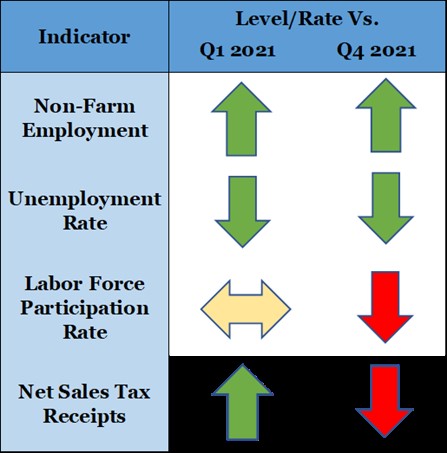

Ripec Bryant Report R I S Gdp Grows For 3rd Straight Quarter

2022 Capital Gains Tax Rates By State Smartasset

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator